This article provides a step-by-step guide on how to build a professional stock trading platform. It is particularly useful for entrepreneurs and financial institutions looking to develop a robust trading infrastructure like OptionX. Trading platforms have gained significant traction in recent years due to their efficiency, real-time execution, and accessibility. With the rise of mobile and algorithmic trading, it has become easier for traders and investors to execute trades seamlessly. Additionally, modern trading platforms offer intuitive user interfaces, catering to both professional traders and institutions. The increasing demand for advanced order management systems (OMS) and risk management tools has further fueled the need for high-performance trading solutions that allow firms to streamline their operations and optimize execution strategies.

An Overview of OptionX

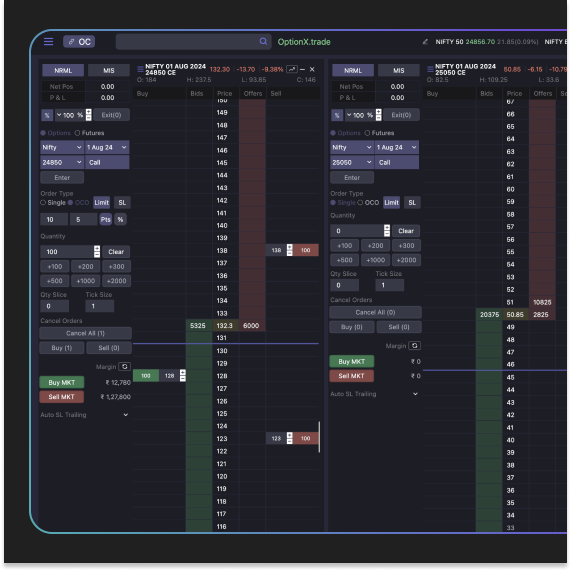

OptionX, founded in 2023 and headquartered in Menlo Park, California, is a cutting-edge Order Management System (OMS) designed to provide brokers and trading firms with seamless execution and advanced trading capabilities. By August 2024, OptionX had gained immense traction among brokers as a state-of-the-art OMS solution, offering unparalleled speed, precision, and automation.

Key Features of OptionX

- OCO Bracket Orders – Efficient risk management with One-Cancels-the-Other order execution.

- One-Click Trading – Ultra-fast execution for seamless order placement.

- Option Chain – Intuitive interface for analyzing and executing options strategies.

- Price Ladder – Real-time market depth visualization for better order execution.

- Profit Protection – Automated tools to secure gains and manage risk.

- Free Paper Trading – Risk-free trading simulations for strategy testing.

- Auto Trailing Stop Loss Orders – Dynamic stop-loss adjustments for optimized risk management.

- TradingView Charts – Integrated professional charting for advanced market analysis.

- Index Level-Based Trading – Execute trades based on real-time index levels.

- Auto Spread Trader – Automated spread trading for complex strategy execution.

OptionX continues to drive innovation in trading infrastructure, providing brokers with a next-generation OMS built for speed, reliability, and scalability.

How Does OptionX Work?

OptionX is an advanced Order Management System (OMS) designed to empower brokers, hedge funds, and proprietary trading firms with seamless order execution, risk management, and compliance monitoring. It serves as the backbone of trading infrastructure, enabling high-frequency trading, smart order routing, and real-time trade monitoring.

Key Functionalities of OptionX

- Ultra-Low Latency Execution – Achieve lightning-fast trade execution with minimal slippage.

- Smart Order Routing – Ensures best execution by dynamically routing orders to the most optimal exchange or liquidity provider.

- Multi-Asset Trading Support – Trade equities, derivatives, forex, and commodities within a unified system.

- Advanced Risk Management – Real-time monitoring of margin utilization, position limits, and compliance to prevent risky trades.

- Algorithmic Trading Integration – Supports custom trading algorithms for automated and systematic trading strategies.

- High Availability and Scalability – Cloud-ready architecture ensures uninterrupted trading and scalable performance.

- FIX and API Integration – Connects seamlessly with major exchanges, brokers, and trading platforms using industry-standard protocols.

- Regulatory Compliance Tools – Built-in reporting and audit tools to comply with market regulations.

Who Can Use OptionX?

OptionX is tailored for professional trading firms and brokers that require institutional-grade technology to manage large trade volumes and execute strategies with precision. It is ideal for:

- Brokerage Firms – Providing retail and institutional clients with a seamless trading experience.

- Hedge Funds – Managing large-scale trades and executing algorithmic strategies efficiently.

- Proprietary Trading Desks – Optimizing in-house trading strategies with high-speed execution.

- Market Makers – Ensuring continuous liquidity with ultra-fast order processing.

- Financial Institutions – Enhancing risk control and trade automation capabilities.

How to Get Started?

Integrating OptionX into a trading ecosystem is seamless, whether via direct API connection or a complete platform deployment. Here’s how brokers and institutions can onboard OptionX:

- Request a Demo – Understand the full suite of features and capabilities.

- Integration & Setup – Connect via FIX API, REST API, or direct exchange integrations.

- Customization & Configuration – Tailor the system to specific trading needs and compliance requirements.

- Go Live – Begin trading with real-time execution, order routing, and risk controls in place.

OptionX redefines how brokers and trading firms manage trade execution, offering unparalleled speed, efficiency, and reliability in today’s fast-paced markets.

Key Features of OptionX

OptionX is a state-of-the-art Order Management System (OMS) designed for brokers and professional trading firms. It offers a powerful suite of features that enable seamless trade execution, risk management, and automation. Built for speed and precision, OptionX ensures high-performance trading with an intuitive yet sophisticated interface.

Killing Features:

- Ultra-Low Latency Execution – Ensures lightning-fast trade execution with minimal delays.

- Smart Order Routing – Automatically routes orders to the best exchange or liquidity provider.

- Multi-Asset Trading – Supports equities, options, futures, forex, and commodities trading.

- Advanced Order Types – Includes OCO (One-Cancels-the-Other), bracket orders, stop-loss, and trailing stop orders.

- TradingView Chart Integration – Professional-grade charting with real-time market data and technical indicators.

- Price Ladder Trading – Allows traders to place orders based on real-time bid/ask depth.

- Risk Management & Compliance – Real-time margin monitoring, P&L tracking, and regulatory reporting tools.

- Algorithmic Trading Support – Seamless integration with algo trading strategies via API.

- Auto Spread Trader – Automates spread trading strategies for options and futures.

- Paper Trading Mode – Enables users to test strategies in a risk-free simulated environment.

- Customizable Trading Dashboard – Personalized interface with watchlists, alerts, and execution shortcuts.

OptionX is built for traders who require cutting-edge technology, ensuring seamless trade execution, risk control, and market access in a high-speed trading environment.

How Does OptionX Generate Revenue?

As a state-of-the-art Order Management System (OMS), OptionX provides brokers and financial institutions with robust trading infrastructure. Unlike traditional retail trading apps, OptionX is designed for institutional clients, and its revenue model is structured around high-performance, enterprise-grade services.

Revenue Streams of OptionX

- Software Licensing – OptionX operates on a subscription-based licensing model, where brokers and financial firms pay for access to its OMS platform. Pricing may vary based on the number of users, trade volume, and feature set.

- Transaction-Based Fees – Brokers using OptionX may be charged a fee per executed trade, ensuring a scalable revenue model that aligns with trading activity.

- API & Integration Services – OptionX offers advanced FIX API and custom integrations for brokers and hedge funds, which are monetized as enterprise-level add-ons.

- Premium Features & Customization – Advanced risk management tools, algorithmic trading support, and compliance modules are available as premium offerings for clients requiring custom solutions.

- Market Data & Analytics – OptionX provides institutional clients with real-time market data, trade analytics, and historical performance insights, which can be monetized via data subscriptions.

- Cloud & On-Premise Deployment – Clients can choose between cloud-hosted OMS solutions or dedicated on-premise infrastructure, with pricing structures varying based on performance needs.

- White-Label Solutions – OptionX allows brokers to deploy a fully branded OMS, generating revenue through white-label licensing and customization services.

Understanding different monetization strategies helps brokers and trading firms make informed decisions when selecting an OMS. OptionX offers a flexible pricing model that scales with business growth, ensuring cost-effective access to high-performance trading infrastructure.

How to Develop an OMS Like OptionX in 5 Steps

Developing a professional-grade Order Management System (OMS) requires a structured approach. Below, we outline the essential steps involved in building a robust OMS for brokers and trading firms.

Step #1: Research

The research phase is a crucial part of the development process for an OMS like OptionX. During this stage, the development team gathers insights to define system requirements, architecture, and regulatory compliance while ensuring seamless order execution and risk management.

At the end of the research process, you should have these questions answered:

- What asset classes (equities, options, futures) will your OMS support?

- Which order types (OCO, bracket orders, trailing stops) should be integrated?

- What market connectivity (exchanges, clearinghouses, liquidity providers) is required?

- How will your OMS handle compliance (SEBI, SEC, MiFID) and security protocols?

- What level of customization and automation will your clients need?

Step #2: Choose the Right Deployment Model

When building an Order Management System (OMS) like OptionX, selecting the right deployment model is critical to ensuring performance, scalability, and accessibility. Here are the main options to consider:

- On-Premise Deployment: Ideal for brokers and institutions requiring full control over infrastructure, security, and compliance. This setup ensures high availability and data privacy but requires significant IT resources for maintenance.

- Cloud-Based OMS: A flexible and scalable approach that enables real-time trading, seamless updates, and cost efficiency. Cloud OMS solutions can be hosted on AWS, Google Cloud, or Azure, providing robust security and high-speed execution.

- Hybrid Deployment: Combines the security of on-premise infrastructure with the flexibility of cloud-based components. This model is beneficial for firms needing both performance and scalability while maintaining strict regulatory compliance.

Some firms may also choose a web-based OMS accessible via a browser, ensuring cross-platform compatibility. However, for high-frequency trading and real-time execution, a native on-premise or cloud-based OMS is preferred.

Step #3: Choose the Right OMS Software Vendor

Selecting a reliable Order Management System (OMS) software vendor is crucial to the success of your trading infrastructure. A well-experienced vendor ensures high performance, regulatory compliance, and seamless integration with brokerage operations.

Key Factors in Choosing an OMS Vendor:

- Industry Expertise: Partner with a vendor specializing in OMS solutions for brokers, proprietary trading firms, and financial institutions. A strong background in market connectivity, FIX protocol integration, and risk management is essential.

- Scalability & Performance: The OMS should support high-frequency trading, low-latency execution, and the ability to handle large trading volumes without system bottlenecks.

- Regulatory Compliance: Ensure that the vendor follows market regulations such as SEBI, SEC, MiFID II, and FINRA standards. A compliant system minimizes legal risks and enhances trust.

- Customization & Integration: A robust OMS should be flexible enough to integrate with multiple exchanges, clearinghouses, market data providers, and third-party risk management tools.

- Proven Track Record: Choose a vendor with successful OMS deployments and case studies showcasing reliability and performance in live trading environments.

OMS Development Team Composition:

The composition of an OMS development team depends on the project's complexity and trading firm requirements. Key roles typically include:

- Software Engineers: Responsible for core system architecture, APIs, and trading logic.

- Data Analysts: Ensure accurate real-time market data processing and analytics.

- UX/UI Designers: Build intuitive dashboards and order execution interfaces.

- QA Engineers: Perform stress testing, security audits, and functionality checks.

- Project Manager: Oversees timelines, stakeholder communication, and regulatory adherence.

The right software vendor and development team will help you build a cutting-edge OMS that meets your brokerage's specific needs and scales with market demands.

Step #4: Ensure Regulatory Compliance

Regulatory compliance is a critical component of developing an Order Management System (OMS) for brokers and trading firms. Ensuring adherence to financial regulations protects market integrity, prevents fraud, and enhances trust among traders and institutions.

Key Regulatory Bodies for OMS Compliance:

Depending on your region of operation, your OMS must comply with the regulations set by financial authorities. Some key regulators include:

- SEBI (Securities and Exchange Board of India): Ensures fair trading practices, market transparency, and investor protection in India.

- SEC (Securities and Exchange Commission): Regulates securities markets and trading activities in the United States.

- FINRA (Financial Industry Regulatory Authority): Oversees brokerage firms and securities professionals in the U.S.

- MiFID II (Markets in Financial Instruments Directive II): A European Union regulatory framework aimed at increasing transparency and investor protection.

- CFTC (Commodity Futures Trading Commission): Regulates derivatives markets, including futures and options trading.

- FinCEN (Financial Crimes Enforcement Network): Enforces anti-money laundering (AML) policies in financial institutions.

- BSA (Bank Secrecy Act): Prevents financial crimes such as money laundering and fraud.

- NFA (National Futures Association): Regulates futures and derivatives trading in the U.S.

Compliance Measures for OMS Development:

- AML & KYC Integration: Implement robust Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures to verify user identities and prevent fraud.

- Trade Reporting & Audit Trails: Maintain accurate records of all trades, ensuring compliance with market surveillance and reporting standards.

- Risk Management & Margin Controls: Implement automated risk checks to prevent unauthorized trading activities.

- Data Security & Privacy: Adhere to GDPR, SEBI, and other relevant data protection regulations to safeguard client information.

- Exchange Connectivity Compliance: Ensure seamless integration with regulatory-approved exchanges and clearinghouses.

A fully compliant OMS enhances operational efficiency and mitigates legal risks, ensuring seamless trading execution while meeting global regulatory standards.

Step #5: Testing & Quality Assurance

Rigorous testing is crucial for ensuring the reliability, speed, and security of an Order Management System (OMS). Given the high-frequency nature of trading, even minor glitches can result in significant financial losses. This stage involves extensive testing to validate system performance, compliance, and user experience.

Key Testing Phases for OMS Development:

- Unit Testing: Each individual module (e.g., order execution, risk management, market data handling) is tested independently to ensure proper functionality.

- Integration Testing: Verifies that different components (OMS, Risk Engine, APIs, and Exchange Connectivity) interact seamlessly.

- Performance & Load Testing: Evaluates system stability under high trading volumes, ensuring ultra-low latency execution.

- Security Testing: Protects against cyber threats, unauthorized access, and vulnerabilities in authentication mechanisms.

- Regulatory Compliance Testing: Ensures adherence to SEBI, SEC, MiFID II, and other regulatory frameworks by validating trade reporting, risk controls, and KYC/AML measures.

- User Acceptance Testing (UAT): Brokers and traders test the platform in real-world scenarios to confirm usability and functionality.

- Failover & Disaster Recovery Testing: Simulates system failures to test automatic recovery mechanisms and data redundancy strategies.

A well-tested OMS minimizes risks, enhances execution precision, and ensures seamless trading operations, making it a cornerstone of any high-performance brokerage infrastructure.

Protecting User Personal Information

In the world of financial trading, user data protection is not just an option—it's a necessity. Order Management Systems (OMS) handle vast amounts of sensitive financial data, including trade details, user credentials, and fund transfers. A single security breach can lead to severe financial losses, reputational damage, and regulatory penalties. Ensuring the security of an OMS is crucial for compliance, trust, and smooth trading operations.

Key Security Measures for OMS Platforms

- Biometric Authentication: Enables fingerprint and facial recognition login to prevent unauthorized access.

- Multi-Factor Authentication (MFA): Adds an extra security layer by requiring OTPs (one-time passwords) via email, SMS, or authenticator apps.

- Data Encryption: Implements AES-256 encryption for secure storage of user credentials, trade history, and financial transactions.

- Role-Based Access Control (RBAC): Limits user privileges based on their roles (trader, broker, admin) to prevent unauthorized modifications.

- Real-Time Threat Monitoring: Uses AI-powered anomaly detection to identify and prevent fraudulent trading activities.

- Secure API Gateways: Ensures all external and internal API communications are encrypted and monitored for suspicious activities.

- Automated Session Management: Logs out inactive users and prevents simultaneous logins from different locations.

- Regulatory Compliance (SEBI, SEC, MiFID II, etc.): Ensures adherence to financial security regulations, including KYC/AML compliance.

By implementing these security measures, an OMS ensures that brokerage firms, institutional traders, and investors operate in a safe and compliant environment while protecting their sensitive financial data from cyber threats.

How Much Does It Cost to Develop an OptionX-like App?

The cost of developing a trading app like OptionX depends on various factors, including app complexity, development team rates, project duration, and platform choices. Below is an estimated breakdown of development costs based on location.

Development Cost by Location

| Location of Engineers | iOS Development (per hour) | Android Development (per hour) |

|---|---|---|

| The USA | $70 | $60 |

| Poland | $50 | $40 |

| Argentina | $25 | $20 |

| India | $15 | $10 |

Estimated Tech Stack for Developing OptionX

| Component | Technology Stack |

|---|---|

| Frontend | React, Vue (Vuex, Nuxt), Next.js, Angular, TypeScript |

| Backend | Java, Python, Node.js (Nest, Express); MySQL or MongoDB (for data management) |

| Third-party Integrations | Stripe or PayPal (payment processing), Bloomberg, Ultumus, or Thomson Reuters (market data feeds), Auth0 or Okta (identity and authentication) |

Total Estimated Cost

Given that it takes approximately 2,200 hours to design, develop, and test the app for one platform, the total development cost may range between $50,000 to $150,000, depending on the location of your development team.

How Ratel Fintech Can Assist in HFT Software Development

Ratel Fintech offers comprehensive high-frequency trading (HFT) software development services, helping businesses build robust and efficient trading systems. Below are some key ways in which Ratel Fintech can support your HFT software development needs:

Expertise

Ratel Fintech's team consists of experienced developers with deep expertise in HFT software development. With a strong background in financial technology, we specialize in building complex trading systems for financial institutions and proprietary trading firms.

Customization

We develop tailored HFT software solutions that align with your business requirements. Our team collaborates closely with clients to understand their trading strategies and infrastructure needs, ensuring a solution that enhances performance and efficiency.

Innovation

At Ratel Fintech, we continuously explore emerging technologies and cutting-edge techniques to optimize trading performance. Our focus is on improving execution speed, minimizing risks, and enhancing security to keep your trading systems competitive.

Regulatory Compliance

We understand the complexities of financial regulations and ensure that all HFT solutions meet industry compliance standards. Our team incorporates best practices for risk management, cybersecurity, and regulatory adherence.

Ongoing Support

Ratel Fintech provides continuous support for HFT software, including system maintenance, performance upgrades, and troubleshooting. Our goal is to ensure long-term stability and efficiency for your trading operations.

Wrapping Up

In conclusion, building an app like OptionX requires careful planning and consideration of various factors, including the target audience, business model, and key features. Conducting thorough market research and competitor analysis is crucial to understanding user needs and the competitive landscape of trading platforms.

Additionally, a deep understanding of the technical aspects of app development, security protocols, and regulatory compliance is essential. By following a structured development process and collaborating with experienced professionals, it is possible to successfully build and launch an advanced trading app like OptionX that meets market demands and offers a seamless user experience.